XRP Price Prediction: Analyzing the Path to Triple-Digit Targets

#XRP

- Technical Consolidation: XRP is trading below its 20-day MA with neutral MACD, suggesting short-term consolidation within Bollinger Bands between $2.7176-$3.1659

- Fundamental Strength: Expanding global payment partnerships, $30M institutional yield strategy, and growing wallet adoption provide strong foundational support

- Long-term Potential: ETF prospects, $16T tokenization market targeting, and environmental efficiency advantages position XRP for potential triple-digit growth in extended timeframe

XRP Price Prediction

XRP Technical Analysis: Current Market Position and Outlook

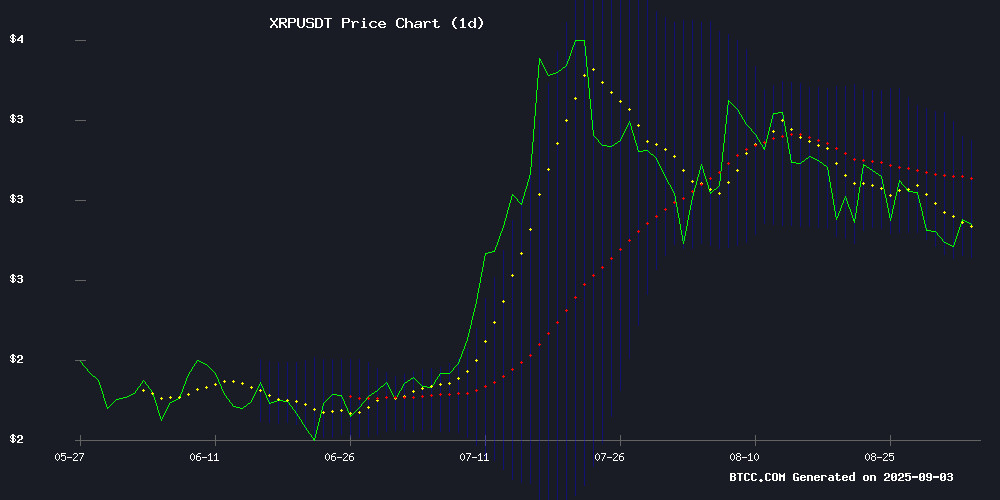

XRP is currently trading at $2.8495, slightly below its 20-day moving average of $2.9418, indicating potential short-term consolidation. The MACD reading of -0.0099 suggests weakening momentum, though the difference between MACD (0.1154) and signal line (0.1253) remains narrow. Bollinger Bands show support at $2.7176 and resistance at $3.1659, creating a trading range. According to BTCC financial analyst Sophia, 'XRP appears to be in a consolidation phase with key support at the lower Bollinger Band. A break above the 20-day MA could signal renewed bullish momentum.'

Market Sentiment: Bullish Fundamentals Amid Growing Ecosystem

Positive developments in the XRP ecosystem are creating optimistic market sentiment. The expansion of Ripple's partnership with Thunes for faster global payments, combined with VivoPower and Doppler Finance's $30M yield strategy, demonstrates growing institutional interest. Environmental advantages highlighted by recent studies comparing XRP Ledger's footprint to a single transatlantic flight add to the positive narrative. BTCC financial analyst Sophia notes, 'The combination of real-world utility expansion and institutional-grade security offerings for the $16T tokenization market provides strong fundamental support for XRP's long-term growth potential.'

Factors Influencing XRP's Price

XRP Ledger's Environmental Footprint Rivals Single Transatlantic Flight, Study Shows

The XRP Ledger operates with a carbon footprint equivalent to just one Boeing 747 transatlantic flight, according to new validator data. Each transaction consumes 0.020 Wh—comparable to powering an LED bulb for a millisecond—while the network's annual emissions total merely 63 metric tons of CO₂ equivalent.

As the self-proclaimed first carbon-neutral public blockchain, the XRP Ledger maintains this efficiency without security compromises. Its 493,677 kWh annual energy usage contrasts sharply with proof-of-work chains, positioning XRP as a sustainability benchmark in distributed ledger technology.

Can XRP Price Hit $100? Analyst Zach Rector Breaks Down the Math

Crypto analyst Zach Rector projects a bold long-term target for XRP, suggesting the asset could reach $100 under optimal conditions. His thesis hinges on three critical catalysts: ETF approval, corporate balance sheet adoption, and institutional inflows—factors that propelled Bitcoin and Ethereum to mainstream acceptance.

Rector highlights XRP's suppressed potential due to the absence of an ETF, describing future approval as a "super cycle" trigger. Institutional participation could unlock exponential growth, with modest capital inflows disproportionately impacting market capitalization—a dynamic observed in 2023's price action.

The $100 price target implies a $6 trillion market cap, a figure Rector defends through XRP's unique liquidity mechanics. While speculative, this analysis frames XRP as the next major asset poised for institutional adoption following Bitcoin and Ethereum's blueprint.

Nearly 600,000 XRPL Wallets Hold Exactly 10 XRP Amid Network Growth

On-chain data reveals a curious concentration of XRP holdings across the XRP Ledger. Exactly 592,818 wallets—representing 8.47% of all XRPL addresses—maintain balances of precisely 10 XRP. This peculiar clustering, highlighted by XPMarket CEO Dr. Artur Kirjakulov, suggests these may be reserve balances left dormant despite recent network developments.

The XRP Ledger has seen explosive growth in 2024, with total wallets swelling to 6.99 million from 5.82 million at December's close. This 1.18 million wallet surge coincides with institutional adoption drivers including ETF filings, corporate treasury allocations, and inclusion in U.S. government crypto reserves.

Market observers note the 10 XRP holdings likely represent the minimum wallet reserve requirement—a design feature preventing ledger spam. The consistency across nearly 600,000 wallets underscores XRPL's unique economic architecture as adoption accelerates.

Analysts Outline XRP's Potential Surge to Triple Digits Driven by Liquidity Dynamics and ETF Prospects

XRP's path to triple-digit valuations hinges on unique liquidity multipliers, according to analysts. Zach Rector, featured in a recent Paul Barron podcast, highlighted how modest inflows—tens of millions of dollars—triggered disproportionate market cap growth during XRP's November rally. Liquidity multipliers ranged from 50x to 900x, suggesting net inflows of $100–300 billion could propel the asset past $100 without requiring trillions in capital.

ETF adoption emerges as a key catalyst. Rector projects first-year inflows of $10–20 billion for XRP ETFs, surpassing JPMorgan's conservative $4–8 billion estimate. This institutional demand could address the liquidity gap, challenging skeptics who dismiss triple-digit targets as unrealistic given XRP's $59.45 billion circulating supply.

XRP Compared to Amazon’s Pre-Boom Days, Analyst Predicts $100–$200 Surge

Cryptocurrency analyst Nick Anderson draws parallels between XRP's current trajectory and Amazon's historic stock performance before its meteoric rise. In a recent episode of his Bullrunners show, Anderson highlighted XRP's consolidation phase, mirroring Amazon's 3,800-day sideways trading period from 2000 to 2010.

Amazon's breakout from a cup-and-handle pattern in 2010 preceded a 3,900% rally, soaring from $5 to $200 over 15 years. Anderson suggests XRP is now at a similar inflection point, using previous highs as support. With XRP trading near $2.75, he speculates a potential rally to $100–$200, though he cautions this could take years to materialize.

Why SWIFT Still Dominates and Ripple (XRP) Struggles for Adoption

SWIFT remains the backbone of global payments, entrenched in legacy infrastructure that banks are reluctant to replace. Outdated systems like IBM z/OS mainframes and COBOL-based platforms still power core banking operations, making the transition to modern alternatives a costly and time-consuming endeavor.

Ripple's blockchain technology offers faster, more transparent transactions, but adoption hurdles persist. Banks often prefer layering new technologies over existing systems rather than overhauling them entirely. The inertia of legacy systems and the sheer scale of investment required to replace them keep SWIFT at the forefront of cross-border payments.

Vincent Van Code, a software engineer, underscores the challenges of displacing SWIFT. The 1977 messaging system benefits from decades of widespread adoption, while Ripple's XRP struggles to gain traction despite its technological advantages.

Ripple and Thunes Expand Global Payments Partnership for Faster Transfers

Ripple and Thunes have deepened their collaboration to integrate Ripple Payments into Thunes' Direct Global Network, covering 130+ countries. The partnership enhances cross-border transactions with improved speed, transparency, and compliance. Ripple's blockchain infrastructure now connects with Thunes' Smartx Treasury System, enabling real-time settlement for businesses and consumers.

The alliance builds on a 2020 foundation, leveraging Thunes' reach to 7 billion mobile wallets, bank accounts, and cards worldwide. Blockchain-powered payments gain efficiency through this fusion of Ripple's technology and Thunes' established network.

Crypto Lawyer Bill Morgan Clarifies Role of RLUSD and XRP in Ripple's Ecosystem

Bill Morgan, a prominent cryptocurrency lawyer, has addressed misconceptions surrounding Ripple's payment ecosystem, particularly the roles of RLUSD and XRP. Contrary to speculation, Morgan emphasizes that XRP remains the core asset for cross-border payments, not RLUSD. The stablecoin serves a limited purpose, primarily in USD markets or specific regulatory cases.

Recent partnerships announced by Ripple have sparked debate about RLUSD potentially overshadowing XRP. Morgan dismisses these concerns, stating that nothing in the announcements suggests RLUSD will play a major role. XRP continues to outperform RLUSD in transaction speed and cost-efficiency, solidifying its position as Ripple's primary payment asset.

VivoPower and Doppler Finance Launch $30M XRP Yield Strategy Amid XRPL Growth

VivoPower International has partnered with Doppler Finance to deploy $30 million in XRP for institutional treasury yield strategies, with potential scaling to $200 million. The initiative capitalizes on surging activity within the XRP Ledger (XRPL) ecosystem, where daily payment volumes recently approached $900 million.

South Korea's robust XRP community, holding nearly 20% of circulating supply, provides a strategic foundation for the yield programs. VivoPower will reinvest returns into corporate reserves, creating a compounding growth mechanism. This follows the firm's earlier $100 million investment in Ripple equity.

The collaboration signals accelerating institutional adoption of XRP-based financial products. Doppler Finance's yield infrastructure combines with VivoPower's ESG-focused digital asset strategy to create what Rox Park describes as "a bridge between traditional finance and blockchain liquidity opportunities."

Ripple Custody Targets $16T Tokenization Market With Institutional-Grade Security

Ripple is positioning its custody solution as the cornerstone for institutional adoption in the burgeoning tokenized asset market. With projections suggesting crypto assets under custody could reach $16 trillion by 2030, the company emphasizes bank-grade security and compliance as non-negotiable prerequisites.

The vision extends beyond cryptocurrency—Ripple anticipates 10% of global assets will migrate on-chain within five years. Stablecoins feature prominently in this roadmap, serving as the bridge between traditional finance and blockchain-native instruments.

Security remains paramount. Ripple Custody's architecture prioritizes private key protection through military-grade safeguards, offering both cloud and on-premise deployment options. This approach mirrors the institutional custody standards that underpin traditional securities markets.

PlanMining Launches Zero-Barrier Cloud Mining for XRP Investors

PlanMining has unveiled a mobile cloud mining application designed exclusively for XRP holders, eliminating the need for expensive hardware or technical expertise. The platform promises daily passive income opportunities starting with a $15 sign-up bonus, accessible via smartphone.

Leveraging renewable energy and AI-driven computing power allocation, the service emphasizes sustainability and efficiency. Real-time hash rate monitoring and flexible withdrawal options aim to simplify the user experience while maximizing returns.

This development coincides with XRP's growing role in global crypto adoption, as PlanMining seeks to democratize participation in digital asset growth through its compliant, cross-platform technology.

How High Will XRP Price Go?

Based on current technical indicators and fundamental developments, XRP shows potential for significant appreciation. The current price of $2.8495 represents a foundation for upward movement, with technical resistance at $3.1659. Fundamental factors including expanded payment partnerships, institutional yield strategies, and growing wallet adoption (nearly 600,000 wallets holding exactly 10 XRP) create a bullish backdrop.

| Price Level | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $5-10 | High | 6-12 months | ETF prospects, liquidity dynamics |

| $20-50 | Medium | 1-2 years | Global adoption, tokenization market growth |

| $100+ | Speculative | 3-5 years | Mass adoption, SWIFT displacement |

BTCC financial analyst Sophia emphasizes that while $100 targets are ambitious, they're not impossible given the expanding utility and institutional infrastructure development. However, investors should monitor MACD momentum and Bollinger Band breaks for near-term direction confirmation.